Unified Payments Interface

The Unified Payments Interface (UPI) has become a revolutionary force in the fast-paced and constantly changing field of financial technology, completely changing the way digital transactions are conducted in India. UPI, which was created by the National Payments Corporation of India (NPCI), is evidence of the nation’s dedication to promoting an equitable digital economy. Through an examination of UPI’s history, quick uptake, and significant influence on how people and companies handle their financial transactions, this introduction aims to shed light on the relevance of the technology. Officially introduced in April 2016, UPI was born out of the demand for a more convenient and interoperable payment mechanism. UPI was the idea of NPCI, a project supported by major banks and the Reserve Bank of India with the goal of streamlining the difficulties involved in conventional banking procedures.

The goal was very clear: to develop a platform that would enable consumers to use their phones to complete safe, quick, and seamless transactions. UPI has seen an unheard-of rise in popularity since its launch, completely changing how individuals send and receive money as well as how they pay for goods and services. With its easy-to-use interface and ability to conduct transactions without requiring lengthy bank data, UPI has become the leading digital payment option. Because of its straightforward design and the widespread use of smartphones, financial transactions have become more accessible to people from a wider range of socioeconomic backgrounds. A network of banks, financial institutions, and third-party service providers that have adopted this cutting-edge technology define the UPI ecosystem. The user experience has been further streamlined with the advent of Virtual Payment Addresses (VPAs), which enable transactions utilizing unique IDs rather than conventional bank account information.

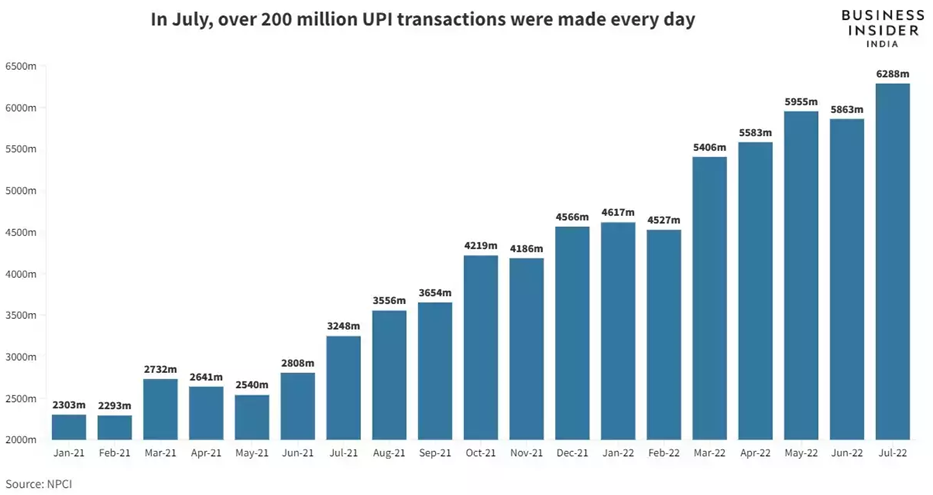

HBM Layout (Source: NPCI)

In the current digital age, where ease and speed are critical, UPI has come to represent financial emancipation. Because of its real-time settlement, bank-to-bank interoperability, and ongoing innovation from different service providers, UPI is now considered a pillar of India’s digital financial infrastructure. It is clear as we dig deeper into the details of UPI—from its benefits and drawbacks to the inner workings of the market and backend—that it is more than just a payment interface. Rather, it is a driving force behind a significant change in the way financial transactions are carried out, ushering in a new era in India’s digital economy.

How UPI Works

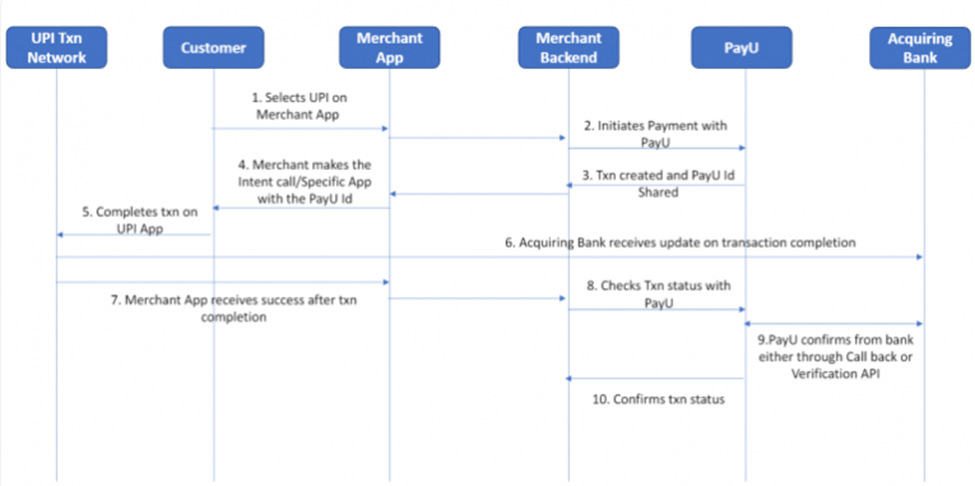

NPCI’s Role: The National Payments Corporation of India (NPCI) plays a pivotal role in the backend operations of UPI. It operates the central switch that facilitates the routing of transactions between different banks. Acting as an umbrella organization for retail payments, NPCI ensures interoperability among various banks and service providers.

UPI Servers and Infrastructure: The backbone of UPI is a robust server infrastructure that manages the vast volume of transactions in real-time. UPI servers act as the intermediaries that process and route transaction requests between the sender’s and recipient’s banks.

Bank Servers and Integration: Each participating bank in the UPI ecosystem maintains its servers that are integrated with the UPI platform. These servers are responsible for handling transaction requests from their respective customers. The integration ensures that the UPI system can communicate seamlessly with the individual banking systems.

Unique IDs and Virtual Payment Addresses (VPAs): At the heart of UPI transactions are the unique identifiers known as Virtual Payment Addresses (VPAs). These VPAs, in the form of “yourname@bank,” serve as the user’s identity and eliminate the need for sharing sensitive information like account numbers and IFSC codes during transactions.

APIs and Protocols: Application Programming Interfaces (APIs) are the bridges that enable communication between different entities in the UPI ecosystem. UPI relies on standardized protocols and APIs to ensure that transactions are executed smoothly across various banks and UPI-enabled apps.

Transaction Request Flow: When a user initiates a UPI transaction, the request flows through a predefined sequence of steps. The sender’s UPI app sends a request to the UPI server, specifying the recipient’s VPA and the transaction amount. The UPI server then communicates with the sender and recipient banks to verify and authorize the transaction.

Authentication Mechanism: Security is a top priority in UPI transactions. The backend employs strong authentication mechanisms, typically involving a secure Personal Identification Number (PIN). This PIN ensures that only the authorized user can initiate and approve transactions.

Real-Time Settlement: UPI is known for its real-time settlement feature. Once the transaction is authenticated, the backend systems ensure an immediate transfer of funds from the sender’s bank to the recipient’s bank. This quick settlement is a key factor in the widespread adoption and popularity of UPI.

Transaction Status and Confirmation: Throughout the process, the backend systems keep track of the transaction status. Both the sender and the recipient receive immediate notifications and confirmations, providing transparency and assurance about the success of the transaction.

Continuous Monitoring and Security Measures: The backend operations of UPI involve continuous monitoring for any suspicious activities or potential security threats. Robust security measures, including encryption and multi-factor authentication, are in place to safeguard user data and financial transactions.

UPI working (Source: Payu)

Advantages of UPI

Seamless Transactions: UPI facilitates seamless transactions by eliminating the need for traditional banking processes. Users can send and receive money with just a few taps on their smartphones, making it incredibly user-friendly.

24/7 Accessibility: Unlike traditional banking hours, UPI transactions can be conducted 24/7, providing users with unparalleled accessibility and flexibility. This round-the-clock availability has significantly enhanced the efficiency of financial transactions.

Interoperability: UPI is designed to be interoperable across various banks, allowing users to link multiple bank accounts to a single UPI ID. This interoperability promotes financial inclusivity and ensures that users are not restricted to a particular banking network.

Instant Fund Transfer: One of the key advantages of UPI is its real-time fund transfer capability. Money is transferred instantly between accounts, reducing the waiting time associated with traditional banking methods like NEFT or RTGS.

QR Code Integration: UPI payments are further simplified through the integration of QR codes. Users can scan QR codes to initiate transactions, making it a convenient option for both merchants and consumers.

Disadvantages of UPI

Cybersecurity Concerns: With the surge in digital transactions, UPIs have become a target for cybercriminals. Issues such as phishing attacks and fraudulent transactions pose significant challenges, emphasizing the need for robust cybersecurity measures.

Dependency on Technology: UPI transactions heavily depend on technology and internet connectivity. This dependency may pose challenges for users in remote areas with limited access to a stable internet connection.

Transaction Limits: While UPI supports quick transactions, there are often limits imposed on the amount that can be transferred in a single transaction. This limitation can be inconvenient for users looking to make large transactions.

Lack of Awareness: Despite its widespread adoption, there is still a segment of the population unfamiliar with UPI. The lack of awareness and understanding of digital payment systems may hinder its full-scale adoption across all demographics.

Market Players and Competition

PhonePe: PhonePe, a popular UPI-based payment app, has gained significant traction with its user-friendly interface and seamless integration with various services. Acquired by Flipkart, PhonePe has become a major player in the digital payment space.

Google Pay: Google Pay, powered by UPI, has emerged as a strong contender in the market. Its integration with the Android ecosystem and intuitive features has attracted a large user base, making it a dominant force in the UPI landscape.

Paytm: Paytm, initially known for its mobile wallet, has seamlessly integrated UPI into its platform. With a diverse range of services, including bill payments and online shopping, Paytm remains a prominent player in the UPI market.

BHIM (Bharat Interface for Money): Developed by NPCI, BHIM is a UPI-based app that aims to simplify digital transactions for users across different banks. Its focus on promoting financial inclusion and interoperability makes it a notable player in the UPI space.